Fundamental and Technical Analysis

POV: You’re at home all warm & cozy, and upon checking out the value of your crypto wallet, you witness a drop in the price of your favorite coin. Your digital wallet has been slapped with a little bit of devaluation, and you want to know why.

One would usually Google it. What the hell happened to Luna? Based on certain events, macroeconomic conditions, trader sentiment or even politics, the prices of cryptocurrencies are impacted by certain micro and macro factors.

The analysis which studies the impact of such factors on the price of an asset is called fundamental analysis. It explores the financial & economic factors which determine and influence the intrinsic value of a security.

On the other side of the spectrum, technical analysis examines the price movement history of a certain asset, currency or other financial instrument in a particular timeframe, to project or speculate future price movements. It’s all about charts, trends and patterns which the analyze the price movement history of an asset to determine the future trajectory of its price.

Both fundamental and technical analysis are incredibly useful in forecasting the future revelations of a cryptocurrency, and hence, the change in its value.

How do they both differ, and what are the advantages & disadvantages of adopting them?

Fundamental Analysis – The Building Blocks of Analysis

One of the ways to understand cryptocurrencies is through fundamental analysis, which arguably comprehends and represents the paramount utility and nature of a crypto asset’s value, based on varying drivers.

Among those drivers would be the activity surrounding the cryptocurrency, the general environment of the industry which the crypto asset calls home, prevalent macroeconomic conditions and the future outlook of the crypto coin.

A simplified example of fundamental analysis surrounding Audius (AUDIO) could be as follows:

There are over 923.5 million AUDIO tokens in circulation, with an average trading volume nearing $40 million, up 35% on a 24-hour basis.

The surge in trading volume may indicate a soar in demand for AUDIO, given higher transaction volumes being recorded over the past several weeks.

Industry Environment

The music streaming industry revenue has grown exponentially in the past year, projected to hit $14.55 billion towards the end of 2022.

Revenue is forecasted to grow at an annual growth rate of 7%, and the number of users is expected to surpass 1.119 billion by 2027; good news for Audius.

Macroeconomic Conditions

The U.S. Federal Reserve has recently hiked interest rates once again, this time by 0.75 percentage points, and this rattled the crypto market.

Despite that, the crypto scene is looking more on the optimistic side, with the market price of major cryptocurrencies including Bitcoin & Ethereum soaring higher the past week.

As a result, trader sentiment towards altcoins appears to be positive, pushing the global cryptocurrency market cap higher by a bit over 11% over the past 7 days.

Future Outlook

Given the current revitalization of demand for Audius after witnessing a heavy blow this year, the future outlook looks pleasant.

Audius is capitalizing on the growing trend of decentralized music streaming. It acquired virtual performance platform Soundstage.fm to further-empower artists with opportunities to grow their brand on personal terms.

Advantages of Fundamental Analysis

Identify opportunities, which typically generate lucrative short-term gains

Spot overvalued & undervalued cryptocurrencies, given supply circulation and activity

Understand the factors which drive the intrinsic value of a crypto asset

Disadvantages of Fundamental Analysis

Short-term oriented, as prevalent factors may not be relevant for long-term investment

Approach differentiation, as it’s difficult to adopt the same approach for different assets

Doesn’t consider the price history & current price trajectory of an asset

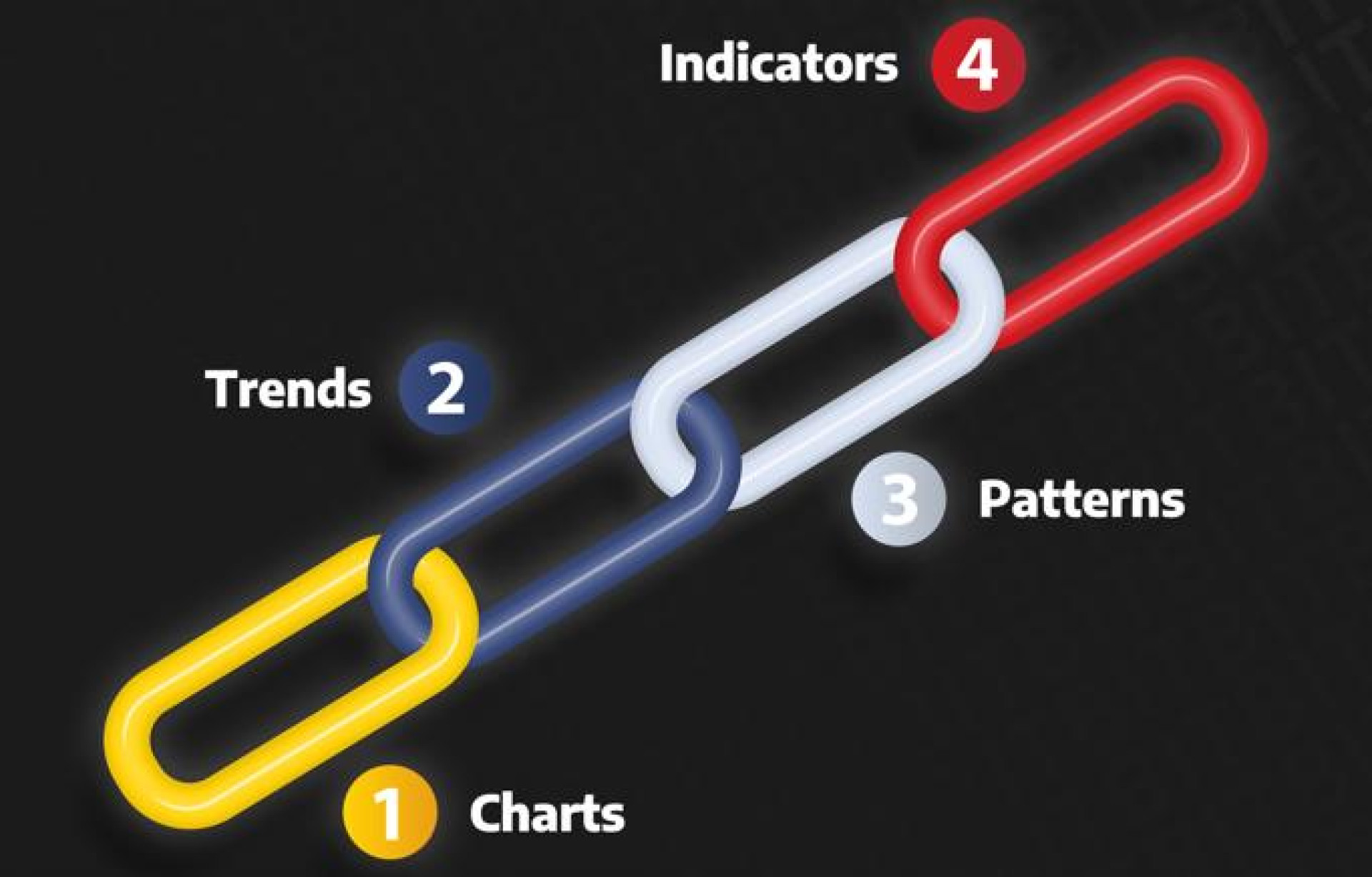

Technical Analysis – The Study of Charts, Trends & Patterns

Without getting too tech savvy, technical analysis centers around the study of price charts, trends and patterns of a cryptocurrency via differentiated indicators and metrics to determine its future direction. Technical analysis aims to evaluate mathematical & statistical trends, in effort to predict the next direction of an asset via an array of indicators which can greatly influence trading activity.

The most widely-utilized simple technical tools are candlestick charts, support & resistance levels, trend lines and moving averages.

Let’s portray the application of such tools using Audius (AUDIO) as an example.

Candlestick Charts

The following candlestick chart presents the price history of AUDIO.

As seen in the chart powered by TradingView, there are two candlestick colors; red & green. Each candle represents a period of time & since this chart presents the AUDIO-USD price on a 1-day timeframe, each candle represents 1 day of price fluctuations.

Red candles indicate a decrease in price, while green candles represent an increase in price. Each candle has a body and wicks. The wicks, which are the lines above and/or below the candle, represent the minimum and maximum prices in a given time period.

Analysts, traders and investors prefer candlestick charts to other chart types, such as line or bar charts, as they show more information regarding the highs & lows of prices, and not just the average or closing price in a specific time.

Support & Resistance Levels

Support and resistance levels are key to interpreting specific price levels which are typically difficult to breach. A support level is a well-grounded price point where prices struggle to trade lower, while a resistance level is the price which markets struggle to surpass and trade higher. Think of support levels as trampoline for prices, as they typically surge higher after touching them, while resistance levels act as barriers to entry.

It is statistically unlikely that prices breach such levels, other than when major events occur. Hence, support & resistance lines are incredibly useful in forming price predictions. The area between support & resistance levels represents the playfield for most price movements.

Trend Lines

In essence, trend lines are single lines which connect different price points over time, and they’re used to draw out the predominant market course.

It’s a simplistic technical tool which can be effective in determining the future asset price trajectory, especially when it connects many price points.

Using Audius as an example, there’s a clear trend line portrayed in the chart above, where the price did not fluctuate beyond the lines. It can be argued that the line on top is a resistance level, while the line at the bottom represents a support level.

Moving Averages

One of the most popular indicators used in technical analysis is the moving average, which tracks the price trend via compiling the averages of past prices of a cryptocurrency in a specific timeframe.

Moving averages are very useful in providing insights into the general direction and inclination of a market, and that aids in finding optimal trade entry prices.

Advantages of Technical Analysis

Excellently portrays market volatility, and that presents short-term trade opportunities

Access to heaps of tools which can be utilized to study price changes

Convenient for short & long-term trading, as indicators can be adjusted for time

Disadvantages of Technical Analysis

Fails to predict third-party factors, assuming future direction based on past fluctuations

Conflicting findings which could skew profit potential

More time consuming than fundamental analysis, especially for beginners

Summary

The collision between fundamental and technical analysts has prolonged for decades. Extreme fundamentalists don’t want to do anything with technical analysis, and vice versa. Yet, when these great forces are combined, prediction of price movements can become more accurate.

Some may argue that fundamental analysis uncovers the answer to the question of what to buy, and technical analysis computes when to buy. Adopting both fundamental and technical analysis in your trading behavior can fortify your chances of long-term success.

BITmarkets posts the most recent and relevant news, alongside its rich educational material to leverage the knowledge and experience of crypto traders.