Crypto đơn giản

Mua hơn 200 loại tiền mã hoá.

Đây là phí giao dịch gần như bằng không với BTMT!

BTMT đã phát huy hết tiềm năng phát triển khi nó hiện chính thức được niêm yết dưới dạng tiền mã hoá độc lập trên sàn giao dịch mua bán và trao đổi của chúng tôi.

BITmarkets tự hào hỗ trợ các vận động viên tài năng. Làm việc chăm chỉ thường là yếu tố quan trọng nhất, và luôn tuyệt vời khi có ai đó đứng sau ủng hộ bạn. Chúng tôi làm việc với một số tài năng lớn nhất trong các môn thể thao của họ và giúp đỡ họ trên hành trình đến vinh quang và chiến thắng. Đây là mục tiêu chính mà chúng tôi hướng tới để đạt được cùng nhau.

Khám pháĐể bắt đầu thực sự ĐƠN GIẢN

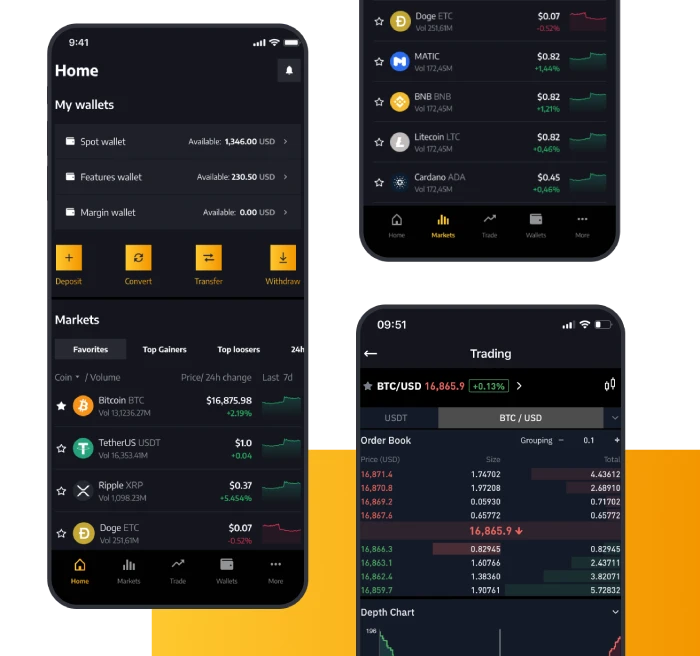

Mua và bán tiền điện tử chưa bao giờ dễ dàng hơn thế. Chúng tôi cung cấp cho bạn các công cụ để đa dạng hóa bằng cách giao dịch trực quan, nhanh chóng và an toàn với hơn 200 loại tiền điện tử. Cảm thấy choáng ngợp? Chúng tôi sẽ hỗ trợ bạn như không có ai khác. Theo nghĩa đen, đường dây của chúng tôi luôn sẵn sàng hỗ trợ ngôn ngữ bạn chọn.

Xác minh danh tính của bạn để bảo mật tài khoản của bạn và tuân thủ các quy tắc và quy định của điều khoản tìm hiểu về khách hàng.

Thêm tiền vào tài khoản của bạn bằng phương thức thanh toán bạn chọn và sẵn sàng bắt đầu giao dịch.

Vâng, nó thực sự đơn giản như vậy - bạn đã sẵn sàng rồi. Tận hưởng vô số tùy chọn để giao dịch và đầu tư.

Tại sao lại giao dịch cùng chúng tôi

Hơn 99% tài sản được lưu trữ trong ví lạnh, Whitelisting và xác nhận giao dịch cũng như dữ liệu cá nhân được mã hóa để giữ an toàn cho tài sản của bạn.

Giao dịch trên một trong những thị trường giao ngay linh hoạt nhất. Tận hưởng một trải nghiệm giao dịch suôn sẻ với sổ lệnh "Tất cả trong một" cho thanh khoản cao hơn, chênh lệch thấp hơn và nhiều cặp tiền hơn.

BITmarkets Futures được nâng cấp đang mang đến một cuộc cách mạng trong giao dịch hợp đồng tương lai Bitcoin khi cho phép ký quỹ và thanh toán đa tài sản. Mở ra những khả năng vô song với danh mục đầu tư của bạn.

Chọn từ hơn 200 loại tiền mã hoá được hỗ trợ như Bitcoin, Ethereum, ChainLink, Dogecoin, Cardano và SHIBA INU trong khi luôn ở tuyến đầu trong việc cập nhật ra mắt các đồng tiền mới.

Khi chúng tôi nói rằng chúng tôi trò chuyện bằng tiền mã hoá, chúng tôi thực lòng có ý như vậy. Đường dây hỗ trợ của chúng tôi hoạt động liên tục với hơn 20 ngôn ngữ, vì vậy hãy yên tâm rằng chúng tôi luôn chăm sóc tốt khách hàng của mình.

Quên FOMO đi. Chúng tôi xử lý hơn 1 triệu yêu cầu mỗi giây nên chúng tôi xử lý giao dịch của bạn ngay khi bạn quyết định thực hiện nó.

Mới biết về tiền mã hoá?

Kiến thức là sức mạnh. Chúng tôi cung cấp cho bạn các công cụ để có thêm kiến thức về tiền mã hoá và giao dịch như một chuyên gia thực thụ.

Kiểm tra nội dung mới nhất từ người dùng BITmarkets

Xem tất cả

Thử mời bạn bè của bạn và kiếm tiền cùng nhau

10% hoa hồng giao dịch của bạn bè bạn và 5% thu nhập của bạn bè bạn.