Will MATIC End its Correction?

Over the past month, the price of MATIC has fallen by nearly 20%, while the trading volume of the popular altcoin remains to be high amongst the ranks.

Recent market trends and technical parameters suggest a bullish outlook for MATIC, driven by increased adoption, strategic partnerships, and continuous network upgrades.

4-hour time frame analysis

MATICUSD - 4 Hour Time Frame

From a technical perspective, the short-term correction currently observed in the market presents an opportunity to capitalize on the fundamental strengths of MATIC at relatively low prices.

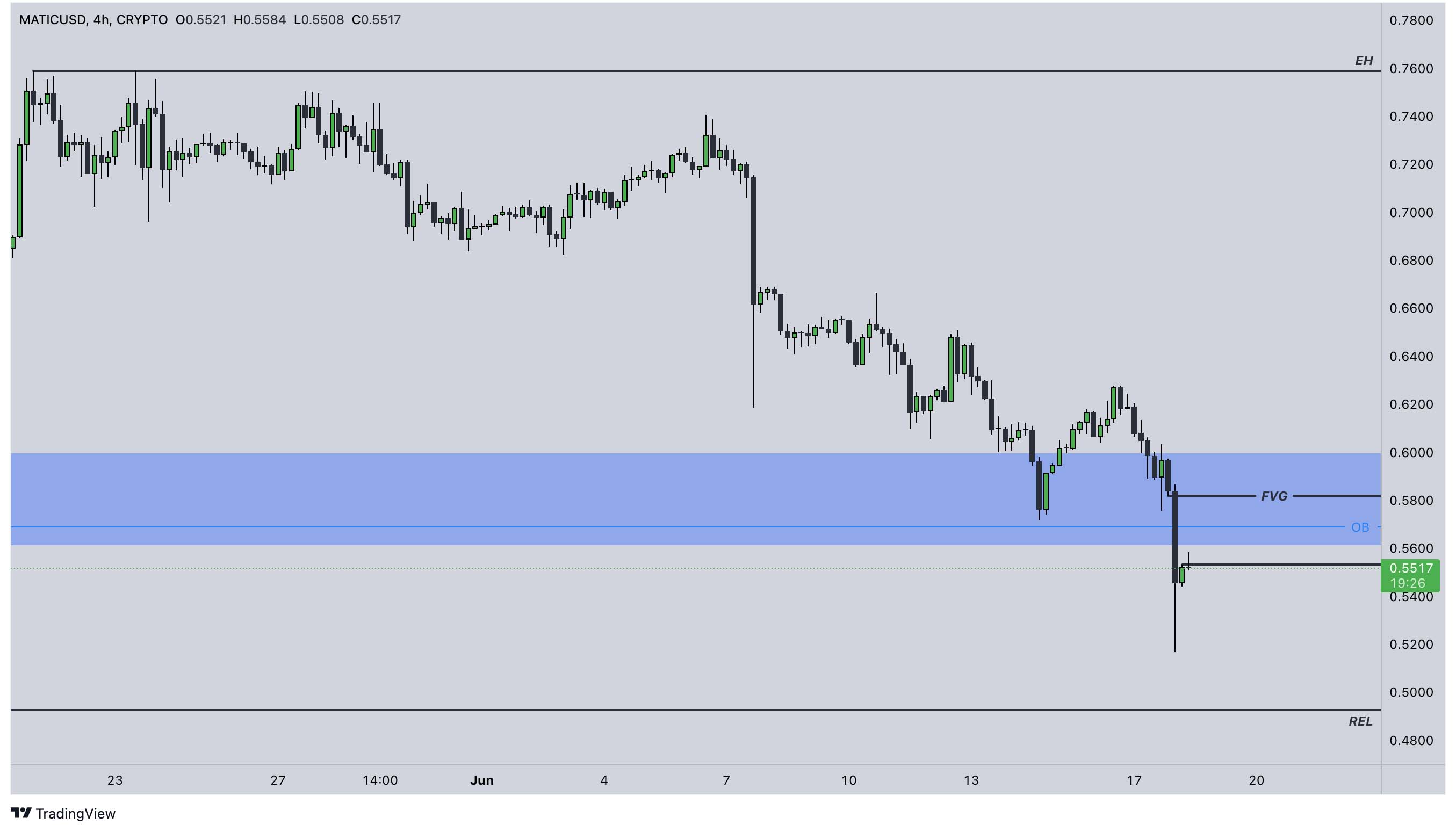

The weekly timeframe reveals two strong bullish indicators: the Order Block (OB) and the support zone identified as the Fair Value Gap (FVG), which is highlighted in blue on the attached chart.

The potential for a future bullish move is supported by the formation of an Inversion Fair Value Gap (IFVG) from the current bearish FVG. If the price closes above the upper level of the FVG on the 4-hour timeframe, it will establish additional support, allowing the price to start forming an impulsive upward move.

In the event of a persistent bearish correction, resulting in the failure to form the next support zone, the price may continue to decline to the Relative Equal Lows (REL) level. This is because Sell-Side Liquidity is located below these lows.

Even though the price has already taken out the initial internal liquidity, the REL is considered external liquidity, containing more order volume than the internal liquidity.

If a pullback down to the REL level occurs, it will still be possible to enter buying positions to leverage the strong fundamental potential of this cryptocurrency and thus strengthen your portfolio.

In both scenarios, it is crucial to set a Stop Loss below the low that will occur if an IFVG forms, and a Take Profit at the level of the Equal Highs (EH) at the price of $0.76.

This analysis suggests that despite the current correction, there are significant opportunities for strategic entry points, leveraging both technical and fundamental indicators to optimize portfolio performance.

Try to invite your friends and earn together

10% of trading fees of your friends and 5% from the earnings of your friends.