Litecoin Presents Profit Opportunity for Buyers

The new trading week has started strong for cryptocurrencies, with Litecoin standing out as one of the top performers. Early price movements suggest that the recent correction may be coming to an end, potentially setting the stage for further gains in the coming days.

However, as always, maintaining proper risk and money management will be crucial. In this analysis, we’ll explore the key factors and market conditions that could determine whether Litecoin can sustain its upward momentum.

4-hour time frame analysis

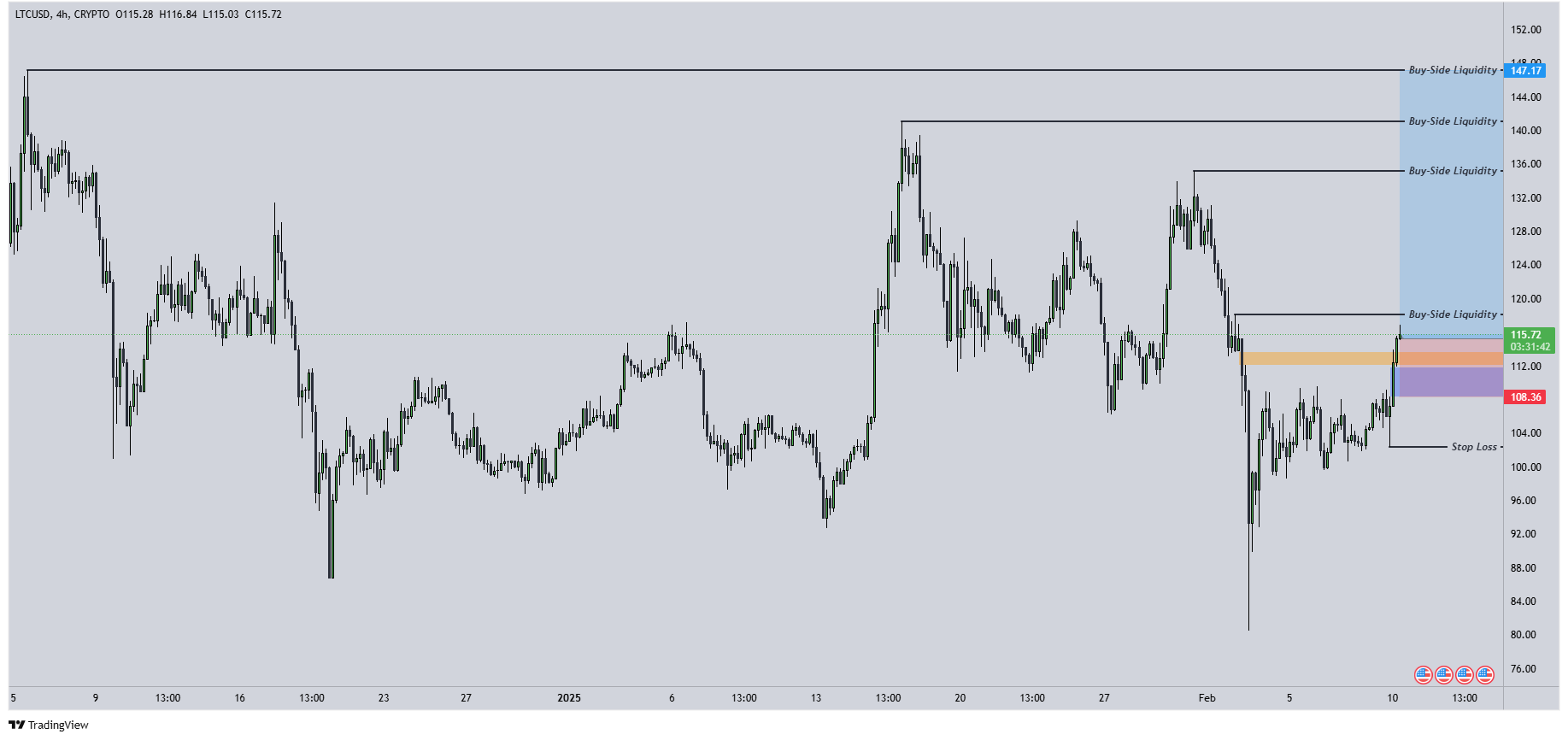

LTCUSD - 4 Hour Time Frame

After a sharp decline across the cryptocurrency market, Litecoin entered a natural consolidation phase, a common occurrence following significant price movements. During this phase, technical indicators were closely monitored to identify potential entry points if the price action signaled a reversal.

This confirmation occurred on Monday when Litecoin’s price successfully closed above a key support zone on the four-hour timeframe—a level previously identified as a resistance zone. In the accompanying chart, this area is highlighted in orange. Additionally, a new support zone has formed, which will play a critical role in managing risk and optimizing trade execution.

Litecoin price target

To ensure proper risk management and optimize trading performance, traders should adhere to three fundamental principles:

Strategic stop-loss placement

It is advised to protect trades with a Stop-Loss order positioned below the internal higher low, as shown on the provided chart. This approach helps control potential downside risks effectively.

Monitoring the latest support zone

Highlighted in blue on the chart, this support zone serves as a key reference point. If the price closes below this level on the four-hour timeframe, it may signal the need to partially exit the position to mitigate losses. Ideally, the price should stay above this zone to maintain its bullish momentum.

Setting take-profit targets

Defining Take-Profit levels is essential for maximizing returns. A recommended strategy is to target Buy-Side Liquidity zones, as the price tends to gravitate toward these areas to facilitate order matching in the market.

By following these principles, traders can effectively manage risk, optimize profit potential, and adapt to market fluctuations, promoting a more structured and disciplined trading approach.

Try to invite your friends and earn together

10% of trading fees of your friends and 5% from the earnings of your friends.