Крипто направено просто

Купете повече от 200 криптовалути.

Тук идват близо до нулевите такси за търговия с BTMT!

BTMT е отключила пълния си потенциал за растеж, тъй като вече е официално листната като самостоятелна криптовалута на нашата борса за покупка и търговия.

BITmarkets гордо подкрепя талантливи атлети. Усърдната работа често е най-важният фактор, и винаги е добре да имате някой зад гърба си. Работим с някои от най-великите таланти в техните съответни спортове и им помагаме в пътуването им към слава и победа. Това е основната цел, която се стремим да постигнем заедно.

РазгледайтеЗапочването е наистина ЛЕСНО

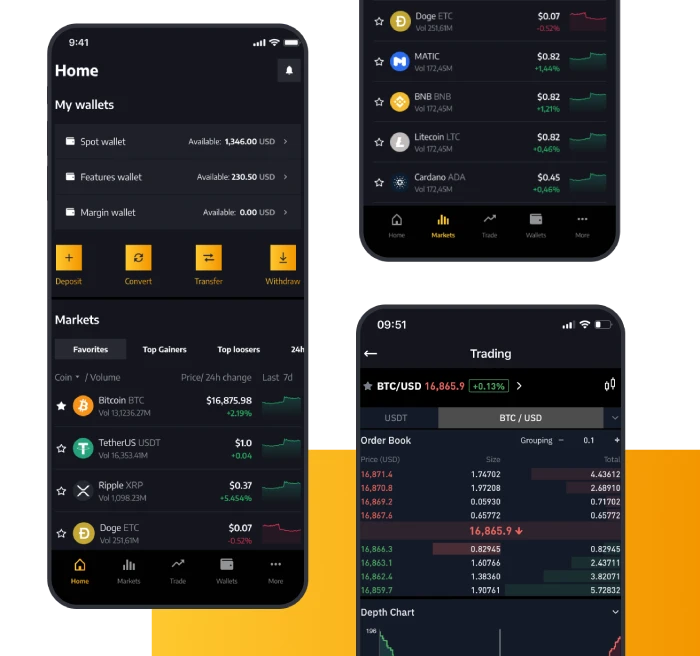

Покупката и продажбата на криптовалути никога не е била по-лесна. Предоставяме ви инструменти за диверсификация чрез интуитивна, бърза и сигурна търговия с повече от 200 криптовалути. Се чувствате претоварени? Ще ви подкрепим като никой друг. Буквално, линията ни е на разположение нон-стоп на език, който вие изберете.

Потвърдете вашата самоличност, за да защитите своя акаунт и да спазвате правилата и разпоредбите за познай-своя-клиент.

Добавете средства към вашия акаунт с плащане по ваш избор и бъдете готови да започнете да търгувате.

Да, наистина е толкова лесно - всичко е готово. Насладете се на огромното разнообразие от възможности за търговия и инвестиции.

Защо търговия с нас

Над 99% от активите се съхраняват в студен портфейл, Уайтлистинг и потвърждения на транзакции, и Криптиране на лични данни, за да се запазят ваши активи на сигурно място.

Търговия на един от най-разнообразните спот пазари. Насладете се на подобрено търговско преживяване с Ол-Ин-Уан поръчкова книга за по-добра ликвидност, по-тесни разлики и по-голямо разнообразие от валутни двойки.

BITmarkets Upgraded Futures въвеждат революция в търговията с бъдещи биткойн фючърси, като позволяват многовариантно марджиниране и урегулиране на активите. Отворете неповторими възможности с портфейла си

Изберете от 200+ поддържани криптовалути,Биткойн, Етериум, ЧейнЛинк, Догекойн, Кардано и ШИБА ИНУ, винаги бъдейки на челната позиция на новите монетни лансирания.

Когато казваме, че говорим крипто, го мислим. Нашата линия за поддръжка работи безпрекъснато на повече от 20 езика, така че можете да бъдете сигурни, че се грижим за нашите клиенти.

Забравете за пропускането на правилния момент за вашата транзакция.Обработваме над 1 милион заявки на секунда, така че обработваме вашата сделка точно в момента, в който решите да я направите.

Нови в крипто?

Знанието е сила. Даваме ви инструментите, за да придобиете повече крипто знание & да търгувате като истински професионалци.

Вижте последното съдържание от хората на BITmarkets

Виж всички

Опитайте да поканите вашите приятели и заедно спечелете

10% от таксите за търговия на вашите приятели и 5% от печалбите на вашите приятели.