Kripto na jednostavan način

Kupujte više od 200 kriptovaluta.

Stižu gotovo nulte provizije za trgovanje s BTMT!

BTMT je otključao svoj puni potencijal za rast budući da sada službeno kotira kao samostalna kriptovaluta na našoj burzi za kupnju i trgovanje.

BITmarkets ponosno podržava talentirane sportaše. Naporan rad često je najvažniji faktor, i uvijek je sjajno imati nekoga iza sebe. Radimo s nekim od najvećih talenata u njihovim sportovima i pomažemo im na njihovom putu prema slavi i pobjedi. Ovo je glavni cilj koji zajedno želimo postići.

IstražitePočetak je stvarno JEDNOSTAVAN

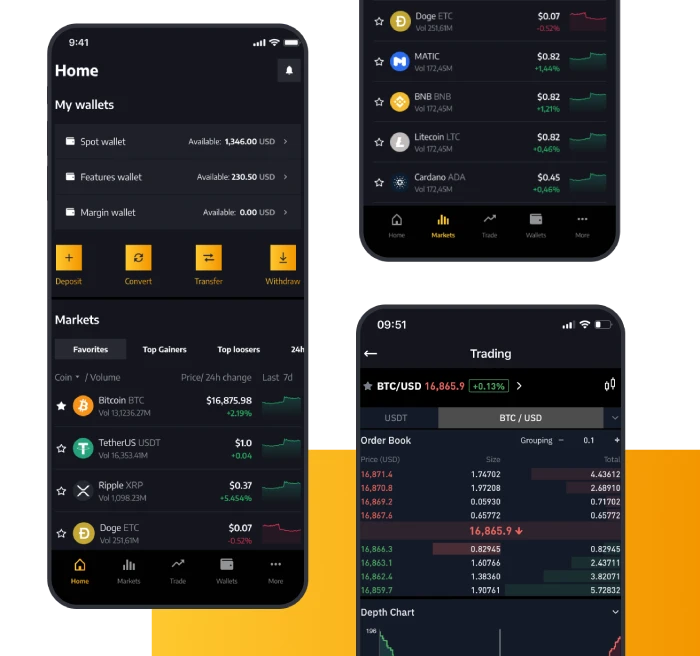

Kupnja i prodaja kripto nikada nije bila lakša. Dajemo vam alate za diverzifikaciju intuitivnim, brzim i sigurnim trgovanjem s više od 200 kriptovaluta. Osjećate se preopterećeno? Podržat ćemo vas kao nitko drugi. Doslovno, naša je linija dostupna non-stop na jeziku po vašem izboru.

Verificirajte svoj identitet kako biste zaštitili svoj račun te ispunjavali uslove pravila i propisa poznavanja korisnika.

Dodajte sredstva na svoj račun metodom plaćanja po vašem izboru i pripremite se za početak trgovanja.

Da, doista je tako jednostavno - spremni ste. Uživajte u velikom izboru opcija za trgovanje i ulaganje.

Zašto trgovati s nama

Više od 99 % sredstava pohranjenih u hladnom novčaniku, popis dopuštenih i potvrde transakcija te šifrirani osobni podaci kako bi vaša imovina bila sigurna.

Trgujte na jednom od najsvestranijih spot tržišta. Uživajte u poboljšanom iskustvu trgovanja uz sveobuhvatnu knjigu narudžbi za veću likvidnost, uže raspodjele i veći izbor parova.

Terminski ugovori BITmarkets Nadograđeni Futures donose revoluciju na području terminskog trgovanja Bitcoinovima, omogućujući marginu i namiru s više sredstava. Otvorite nenadmašne mogućnosti sa svojim portfeljem

Birajte među 200+ podržanih kriptovaluta,Bitcoina, Ethereuma, ChainLinka, Dogecoina, Cardanoa i SHIBA INU-a dok ste uvijek u prvom redu kod lansiranja novih novčića.

Kada kažemo da govorimo kripto, to i mislimo. Naš odjel za podršku radi na više od 20 jezika non-stop, stoga budite uvjereni da brinemo o svojim klijentima.

Zaboravite na propuštanje pravog trenutka za svoju transakciju. Obradimo više od milijun zahtjeva u sekundi tako da obrađujemo vaše trgovanje u trenutku kada ga odlučite provesti.

Novi ste u kriptu?

Znanje je moć. Dajemo vam alate za stjecanje više znanja o kripto području kako biste trgovali kao pravi profesionalac.

Provjerite najnoviji sadržaj od stručnjaka iz BITmarketsa

Vidjeti sve

Pokušajte pozvati svoje prijatelje i zajedno zaraditi

10% od naknada za trgovanje vaših prijatelja i 5% od zarade vaših prijatelja.