Kripto tapo paprastas

Pirkite daugiau nei 200 kriptovaliutų.

Čia ateina prekybos mokesčiai beveik nuliui su BTMT!

BTMT atvėrė visą savo augimo potencialą, kai tapo oficialiai įtraukta kaip atskira kriptovaliuta mūsų biržoje, kurią galite įsigyti ir prekiauti.

BITmarkets didžiuojasi remdama talentingus atletus. Sunkus darbas dažnai yra svarbiausias veiksnys, ir visada puiku turėti ką nors, kas jus palaiko. Dirbame su kai kuriais didžiausiais savo sporto šakų talentais ir padedame jiems jų kelyje į šlovę ir pergalę. Tai yra pagrindinis tikslas, kurio siekiame kartu.

NaršykitePradėti yra tikrai PAPRASTA

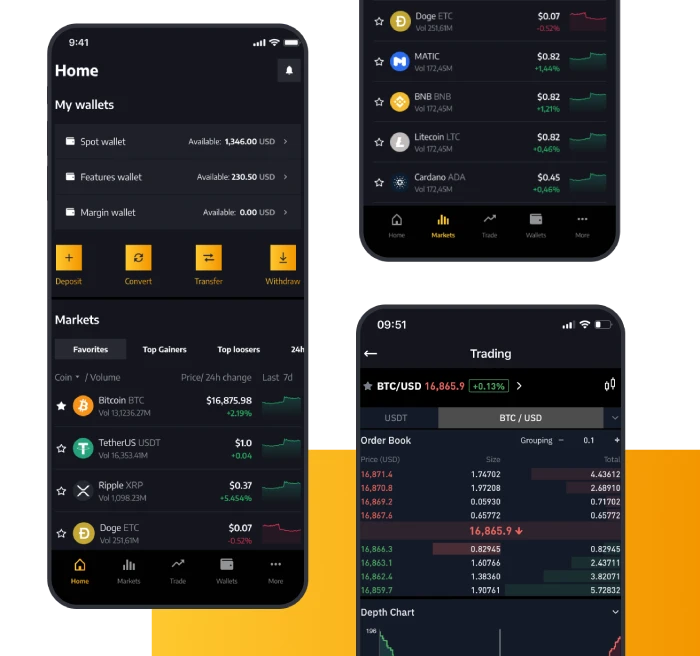

Kriptovaliutų pirkimas ir pardavimas niekada nebuvo lengvesnis. Mes suteikiame jums įrankius įvairinti, intuityviai, greitai ir saugiai prekiaujant daugiau nei 200 kriptovaliutų. Jaučiatės pervargę? Mes jus palaikysime kaip niekas kitas. Visiškai mūsų linija yra pasiekiama nuolatos jūsų pasirinkta kalba.

Patikrinkite savo tapatybę, kad užtikrintumėte savo sąskaitos saugumą ir laikytumėtės klientų atpažinimo taisyklių ir nuostatų.

Papildykite savo sąskaitą pasirinktu mokėjimo būdu ir pasiruoškite pradėti prekiauti.

Taip, tai iš tikrųjų taip paprasta - viskas paruošta. Mėgaukitės įvairiomis prekybos ir investavimo galimybėmis.

Kodėl prekiauti su mumis

Daugiau nei 99% turto saugoma šaltose piniginėse, baltasis sąrašas ir sandorių patvirtinimai, užšifruoti asmens duomenys, kad jūsų turtas būtų saugus.

Prekiaukite vienoje iš universaliausių spot rinkų. Mėgaukitės patobulinta prekybos patirtimi su vienu bendru pavedimų registru, užtikrinančiu didesnį likvidumą, mažesnius skirtumus bei platesnę porų įvairovę.

BITmarkets patobulintos ateities sandoriai atneša revoliuciją Bitcoin ateities sandorių prekyboje, leidžiant kelių turto maržą ir atsiskaitymą. Atverkite unikalias galimybes savo portfeliui

Rinkitės iš daugiau kaip 200 palaikomų kriptovaliutų.Bitcoin, Ethereum, ChainLink, Dogecoin, Cardano ir SHIBA INU, visada būdami priešakinėse naujų monetų paleidimo ribose.

Kai sakome, kad kalbame kriptovaliuta, mes tai ir turime omenyje. Mūsų palaikymo linija veikia daugiau nei 20 kalbų nepertraukiamai, todėl galite būti tikri, kad rūpinamės savo klientais.

Pamirškite apie tai, jog praleidote tinkamą akimirką savo sandoriui. Mes apdorojame daugiau nei 1 milijoną užklausų per sekundę, todėl savo sandorį atliekame tą pačią akimirką, kai tik nusprendžiate jį vykdyti.

Prekiaukite. Bet kur. Bet kada.

Mes teikiame kriptovaliutą VISIEMS. Pirkimas, pardavimas ir prekyba dabar yra paprastesni ir saugesni nei bet kada. Su mūsų itin sparčia programa jūs visada galite būti pasiruošę.

Naujokas kriptovaliutose?

Žinios yra galia. Mes suteikiame jums įrankius, kad įgytumėte daugiau kripto žinių ir prekiautumėte kaip tikras profesionalas.

Peržiūrėkite naujausią turinį iš BITmarkets žmonių

Žiūrėti viską

Pakvieskite draugus ir uždirbsite kartu

10% jūsų draugų prekybos mokesčių ir 5% jūsų draugų pajamų.