Will Jupiter Keep Its Bullish Momentum?

Launched nearly 4 months ago, Jupiter's JUP cryptocurrency has climbed up the crypto ranks, currently regarded as the 60th largest cryptocurrency by market capitalization.

Jupiter focuses on integrating with existing social media platforms and enabling decentralized applications (dApps) to enhance user experiences without sacrificing privacy. Through ongoing development and strategic partnerships, Jupiter is positioning itself as a pivotal player in the field of secure digital communication.

Growing over 60% in that time, JUP has failed to retain its all-time high near the $1.75 mark, dwindling to lows below the one dollar price-tag by the end of April.

JUP has recently recaptured some of its lost gains, growing 30% during the month of May at the time of writing, demonstrates successful initial liquidity pick-up.

Will the fundamentally-robust project continue its bullish trend?

4-Hour time frame analysis

JUPUSD - 4 Hour Time Frame

Jupiter's stable fundamentals are reinforced by various technical price indicators. Notably, a bullish market structure, characterized by a pattern of Higher Lows and Higher Highs (illustrated by blue lines on the chart), supports the positive outlook.

Based on this structure, we have analyzed support zones from which the price is likely to continue rising, providing favorable opportunities for traders to execute orders.

The price has established two significant zones during its impulsive moves, identified as Buy-side Imbalance and Sell-side Inefficiency (BISI) (marked in blue on the chart)

Currently, the price is reacting to the first of these zones, located beneath the critical Fibonacci 0.5 level, which defines the Discount zone. It's crucial to note that by reaching this first support zone, the price has also tapped into the initial Sell-side Liquidity, fulfilling a key aspect of our entry criteria.

Potential scenarios

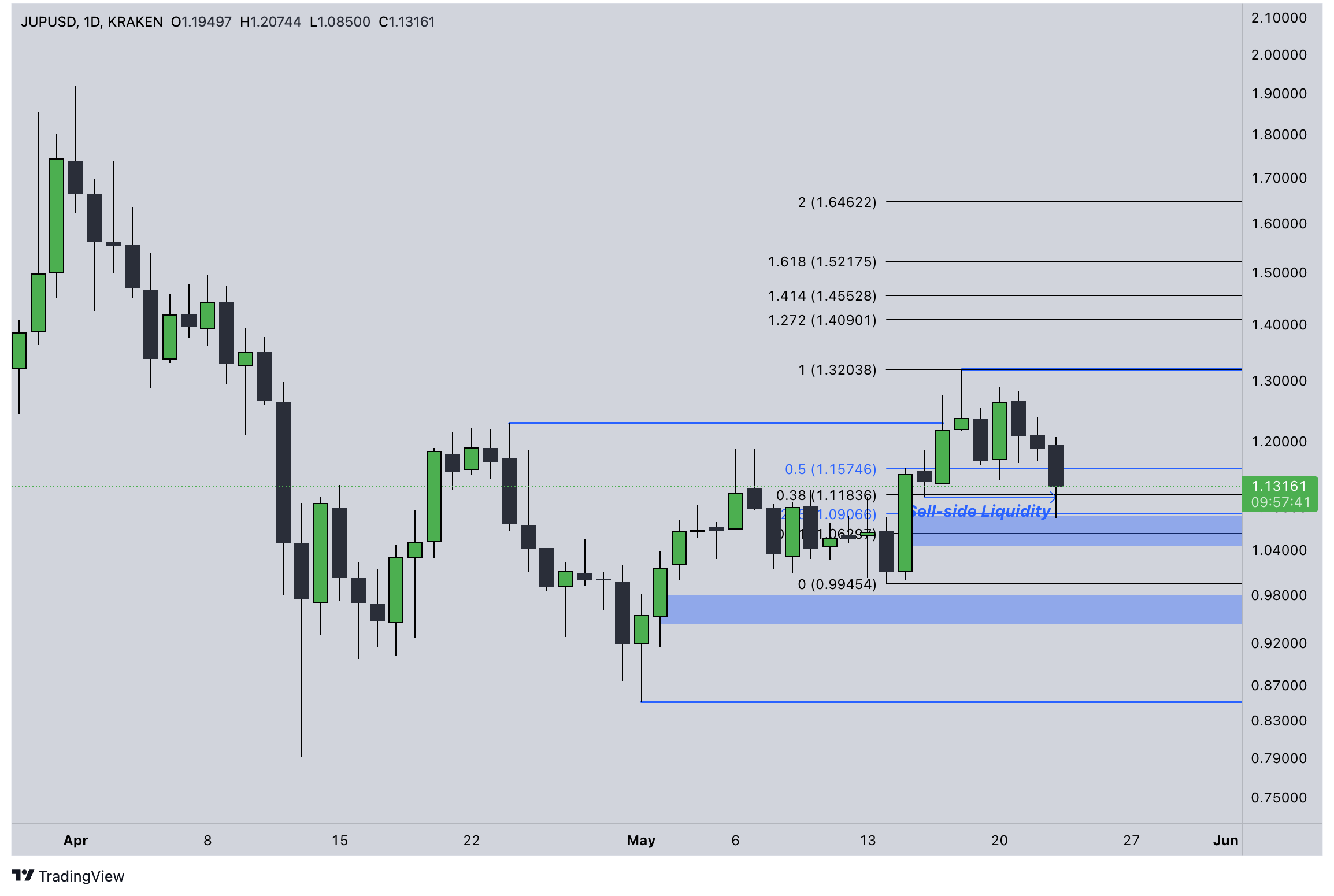

.JUPUSD - 1 Day Time Frame

Scenario 1: The price finds support at the first zone without closing below it on the 4-hour timeframe. This would involve a break of the structures, including Inversion FVG and Order Block, on a lower timeframe.

Scenario 2: The second scenario posits that the price may decline to the second support zone, where it would meet the same entry criteria as the first scenario.

Scenario 3: The third possibility is that the price fails to hold at either support zone, leading to a deeper bearish correction.

For traders considering long positions, it is essential to set a Stop Loss order below the Internal Low and place Take Profit orders at Fibonacci extension levels of 1.272, 1.414, 1.618, and 2, to manage risk effectively and capture potential gains.

You might also be interested in

Don’t miss any crypto news

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

Please enter your email address

Email is invalid

Read how we process your data in our Privacy policy.

Thank you for subscribing 😊

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

If you have any questions about cryptocurrencies or need some advice, I'm here to help. Let us know at [email protected]