When Will Bitcoin's Correction End?

Bitcoin continues its course of price correction after its highly-awaited halving event, shedding more than 7% of its value the past month. However, the world's most popular cryptocurrency reclaimed the psychologically-significant $60,000 support level due to a short squeeze.

The key question now is whether Bitcoin will move higher or require more time to consolidate.

Daily time frame analysis

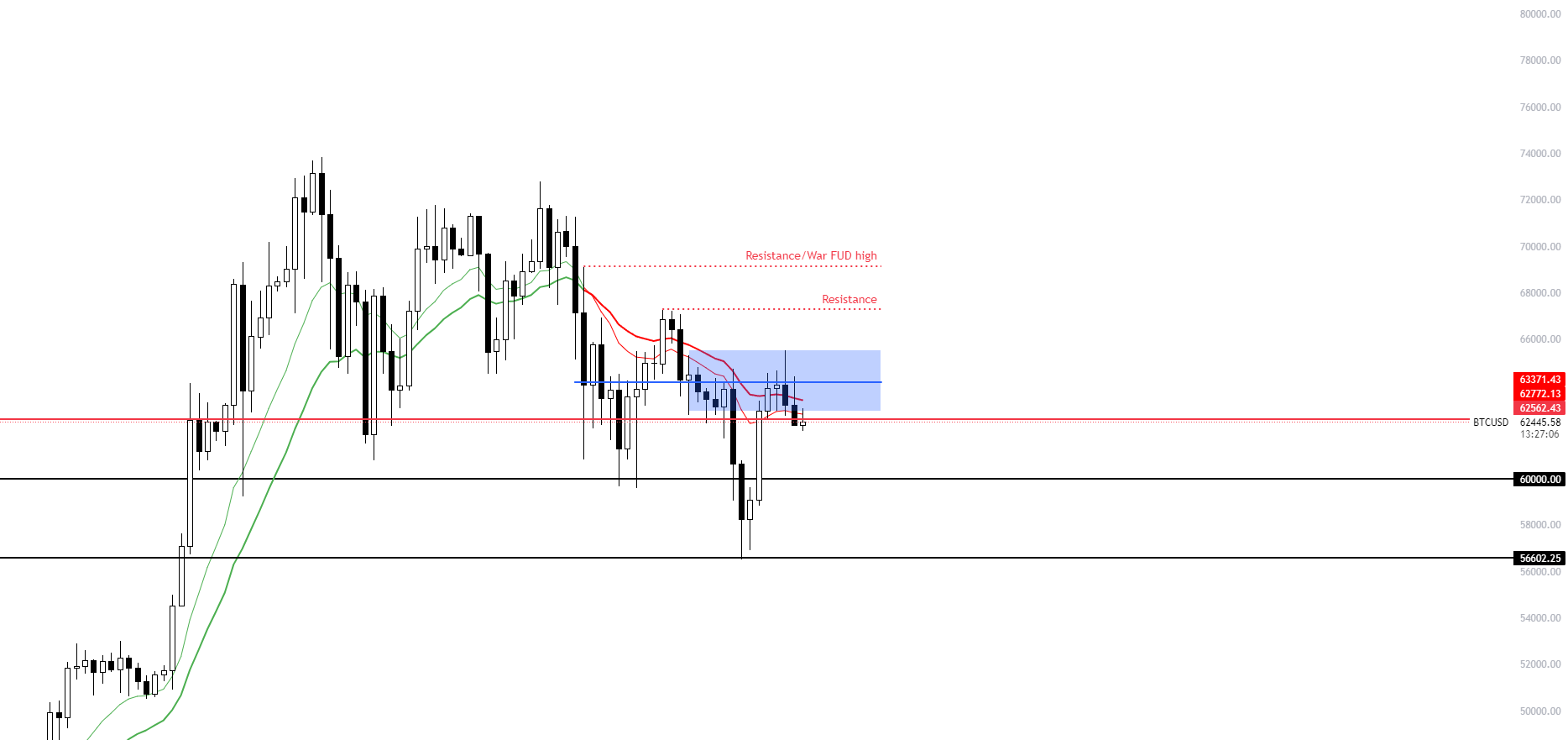

BTCUSDT - 1 Day Time Frame

Bitcoin recently reclaimed $60,000 and rallied to $65,000. However, on the daily time frame, no candle has closed above the marked blue line, which represents the fixed range volume profile around $64,000— a critical level Bitcoin needs to hold.

The marked blue area signifies a range of a daily candle that closed above this level before Bitcoin dipped to $56,000. Currently, the price is ranging below significant support and struggling to reclaim the 12/21EMA bands.

Hourly time frame insights

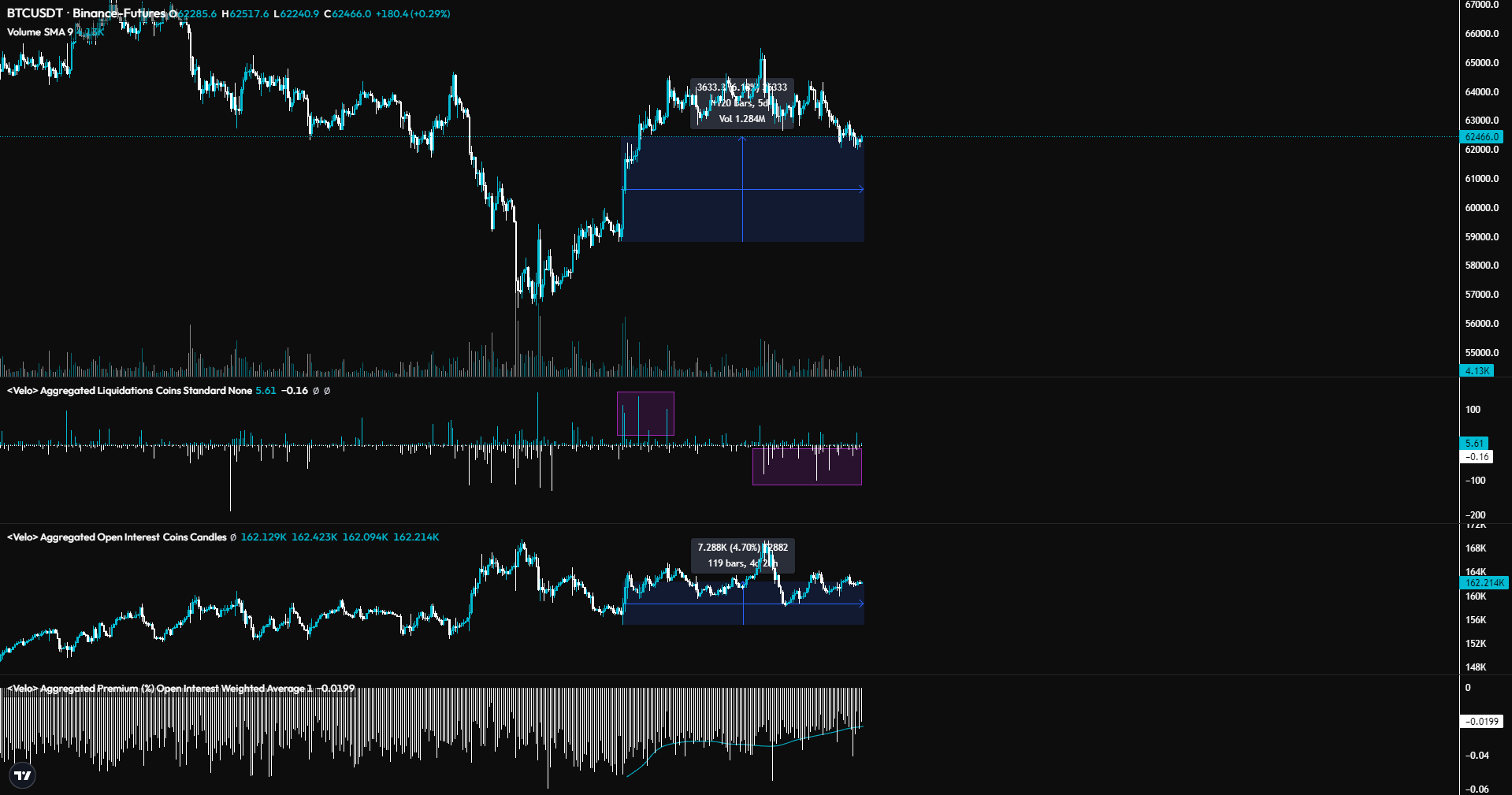

BTCUSDT - 1 Hour Time Frame

The Aggregated Liquidations chart shows a significant number of short liquidations in the purple box, which caused the short squeeze.

These have since cooled off, and long liquidations are now increasing. This may result in a bear trap as traders start to short, but Bitcoin currently appears more bearish.

Open interest from the short squeeze is only 4.70% higher, while the price has increased by approximately 6%, indicating the market is driven by futures.

This is further supported by the Aggregated Premium chart showing an increase in futures premium. However, the funding rate remains neutral, so the futures premium is not a major concern.

Large assets like Bitcoin rarely find a bottom through a V-shaped reversal. The price action has shown a sweep of $65,000, indicating reluctance to move higher. Bitcoin is currently ranging below a previous swing high and an important support level.

What's next for Bitcoin?

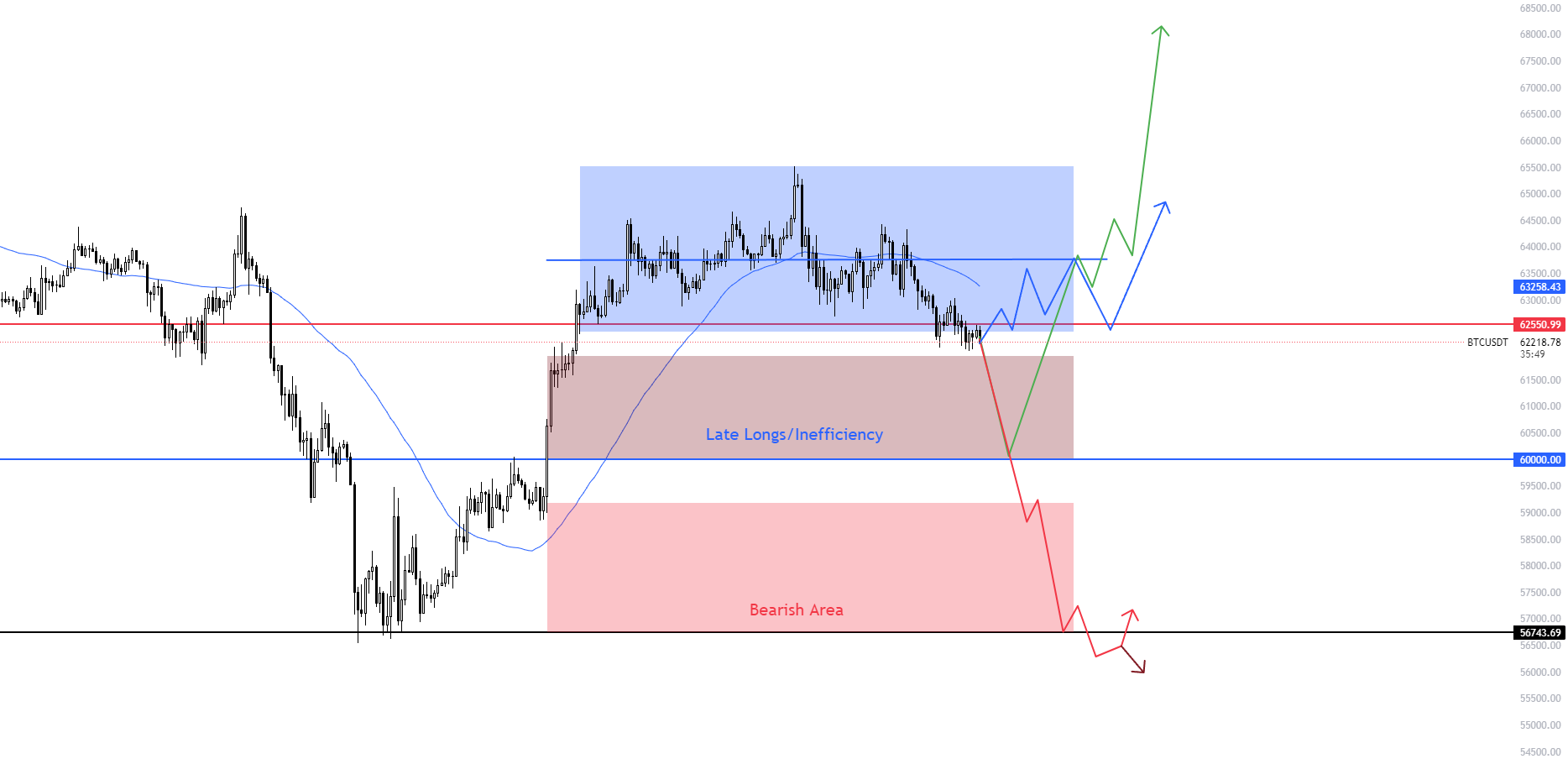

BTCUSDT - 1 Hour Time Frame

There are several potential paths forward, as outlined below:

Green Path: Bitcoin may fill in the inefficiency with continued shorting and more long liquidations, testing the $60,000 level.

If Bitcoin tests this level and does not produce a strong reaction upwards, it may indicate that the price is not ready to reclaim the previous range and could drop to local lows, following the red path, suggesting further downside potential.

Blue Path: This scenario represents a potential bear trap, where the price could return to the blue range. The most significant volume from the short squeeze was conducted around the blue line, which needs to be reclaimed.

The chart also indicates a 50MA band that was lost and then reclaimed, creating a lower high followed by Bitcoin breaking the swing high—possibly a sweep of the lows as per the textbook Wyckoff accumulation pattern.

If Bitcoin moves lower slowly, it indicates less selling volume, and the price could form a higher low on the higher timeframe before seeing an upside.

Bitcoin has not made a new high for nearly two months, leading to a downtrend. For Bitcoin to appear stronger, it should hold at least the $63,000-$64,000 range.

The key now is to wait for Bitcoin to re-enter the range, as a liquidity shock may be imminent.

You might also be interested in

Don’t miss any crypto news

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

Please enter your email address

Email is invalid

Read how we process your data in our Privacy policy.

Thank you for subscribing 😊

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

If you have any questions about cryptocurrencies or need some advice, I'm here to help. Let us know at [email protected]