Bullish Structures for Litecoin Ahead

Litecoin is regaining bullish momentum after an initial setback, fueled partly by the re-election of Donald Trump as President of the United States. This recent upward movement confirms a promising buying opportunity with an attractive risk-reward ratio for traders.

Daily time frame analysis

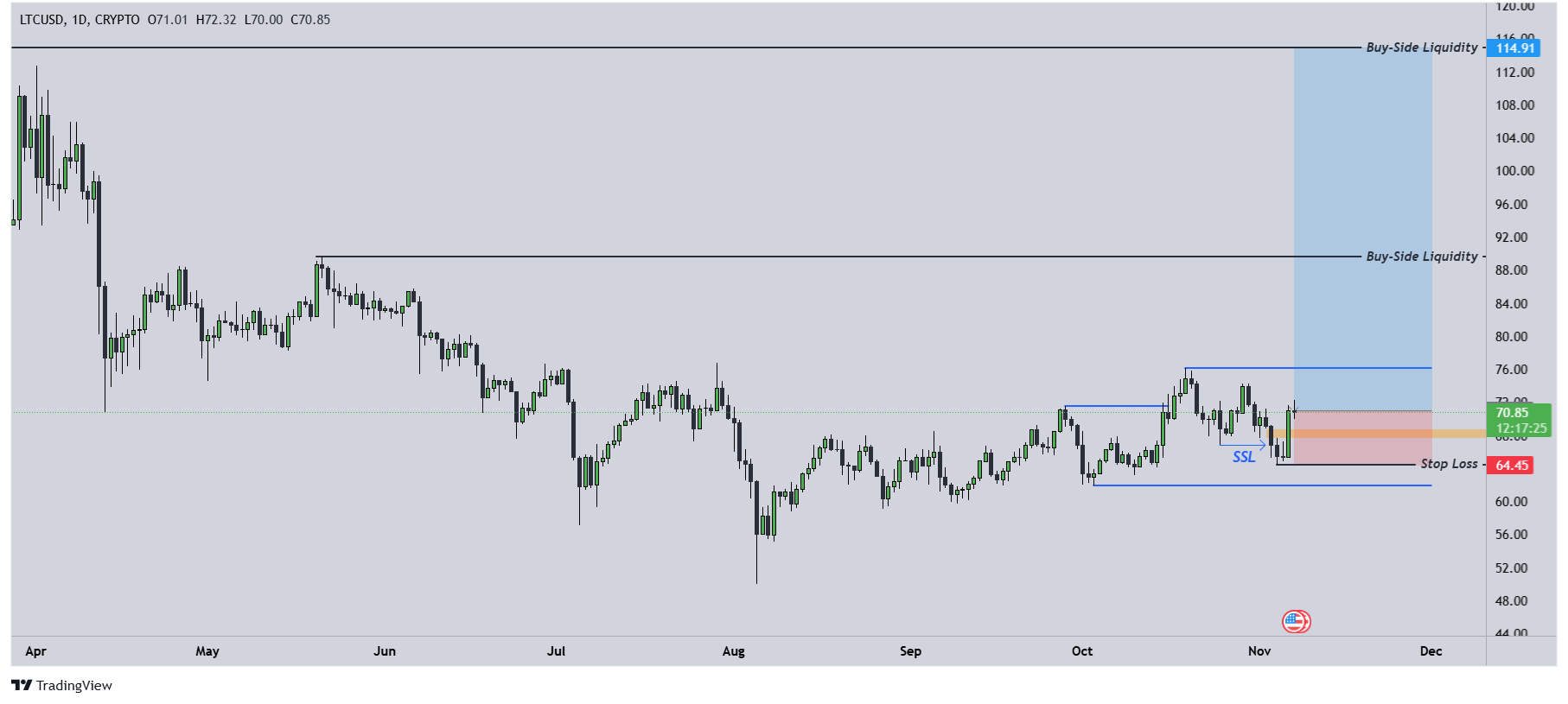

LTC - 1 Day Time Frame

The first days of November did not deliver the expected bullish move, causing Litecoin to experience a temporary dip and another round of Sell-Side Liquidity. However, this bearish phase remained contained within a larger bullish market structure, as highlighted by blue lines on the chart.

This prompted us at BITmarkets to monitor Litecoin's price action closely, paying particular attention to how it interacted with the significant resistance zone that had previously stalled its upward momentum.

With Litecoin now closing bullishly above this resistance level, buy orders have gained strength, signaling that the bullish trend is once again in play.

Litecoin price target

To manage risk while maximizing returns, we have identified several key levels to monitor. A Stop Loss should be set below the internal low to protect against unexpected price drops.

If Litecoin's price on the daily chart closes below the lower boundary of the previous resistance—now serving as a support zone—it may be prudent to sell a portion of the position as a risk management strategy.

Setting Take Profit levels is crucial for securing gains. We suggest placing profit targets at two significant Buy-Side Liquidity levels. The upper target corresponds to Litecoin's highest price of the year, making it an ideal zone for profit-taking if the bullish trend persists.

By carefully managing these levels and monitoring Litecoin’s ongoing price action, traders can capitalize on this second chance for a potential bull run.

You might also be interested in

Don’t miss any crypto news

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

Please enter your email address

Email is invalid

Read how we process your data in our Privacy policy.

Thank you for subscribing 😊

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

If you have any questions about cryptocurrencies or need some advice, I'm here to help. Let us know at [email protected]