Bitcoin Jumps 5% in a Week – What’s Next?

A new trading week brings new opportunities, and Bitcoin is starting strong. Over the weekend, the cryptocurrency closed above a key resistance zone that had previously defined the bearish structure.

This decisive move could signal the potential for continued upward momentum in the days ahead. However, for traders aiming to capitalize on this shift, it’s important to remain cautious and consider the possible scenarios.

Bitcoin technical analysis

BTCUSD - 1 Day Time Frame

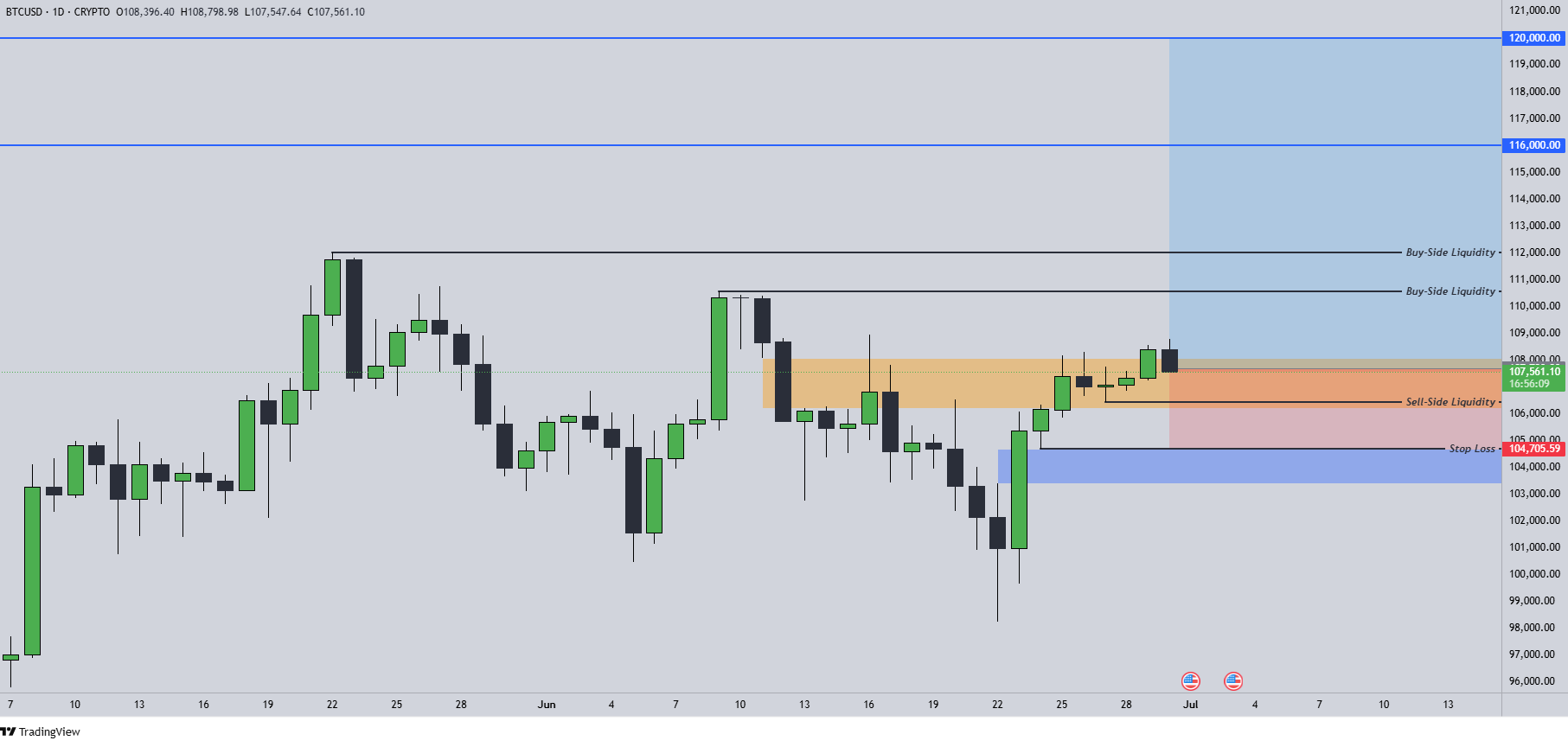

As mentioned, the recent close above the psychological threshold aligns with the key resistance zone, highlighted in orange for visual clarity. While this area has been tested repeatedly in the past, Bitcoin had not previously managed to close above it with a full daily candle body—until now. This breakout sets the stage for a potential opportunity to consider long positions at the beginning of the week.

That said, this particular setup deviates from our typical entry criteria. In most cases, entering long positions can be appropriate when a close above resistance is followed by a liquidity sweep in the discount zone—specifically below the 0.5 Fibonacci level. That condition has not yet been met. While this does not invalidate the setup, it does call for a more cautious and disciplined trading approach.

Bitcoin price target

Two primary scenarios could unfold in the near term. In the first, the price may retrace below the nearest Sell-Side Liquidity level, located within the orange zone—previously resistance, now acting as support due to the recent daily close. In this case, a Stop Loss could be placed just below the upper boundary of the blue support zone, which also plays a central role in the second scenario.

Alternatively, the price may revisit this initial support zone, form an internal low, and bounce—without closing below it on the daily timeframe. If that occurs, it could present a renewed entry opportunity. As always, it's always advised to monitor price action closely before going ahead with any decision.

You might also be interested in

Don’t miss any crypto news

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

Please enter your email address

Email is invalid

Read how we process your data in our Privacy policy.

Thank you for subscribing 😊

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

If you have any questions about cryptocurrencies or need some advice, I'm here to help. Let us know at [email protected]