Polkadot at Crossroads - Down or Up?

Polkadot’s DOT has witnessed several price bumps in recent weeks, and the cryptocurrency is poised to grow in the long term. DOT is 90% away from its all-time high, and our technical analysis readings project’s the coin’s next move.

Weekly time frame

DOTUSD - 1 Week Time Frame

The weekly time frame readings suggest reveal that price has traded higher in recent weeks, successfully breaking out of the present bearish structures to close just below the $10 level.

This has created relatively equal highs, representing a Buy-side Liquidity (BSL) zone. Should this bullish trend prevail, this area can represent the playfield where large institutions will Cash out their holdings for profit.

DOT’s price dropped last week and then returned to the Buy-side Imbalance Sell-side Inefficiency (BISI) zone.

Daily time frame

DOTUSD - 1 Day Time Frame

On the daily timeframe, it can be observed that the price used the Sell-side Imbalance Buy-side Inefficiency (SIBI) area as a stepping stone for its rise.

Buying positions will typically situate above this area, but a possible bearish correction may take place.

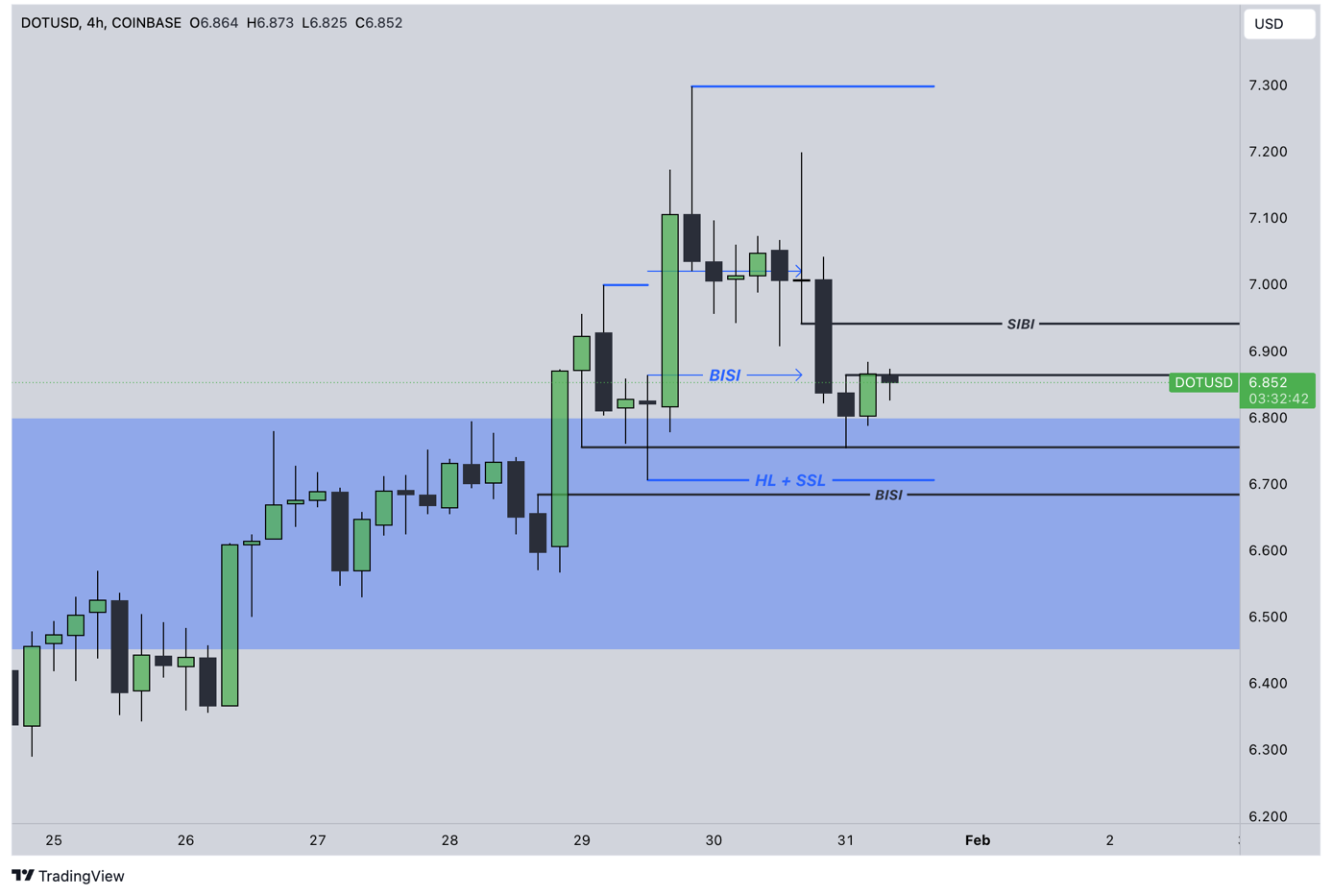

4-hour time frame

DOTUSD - 4 Hour Time Frame

Looking into DOT’s price behavior on the 4-hour timeframe, a bullish structure consistent with the patterns of wider time frames is formed.

Recent movements reveal a price closure below the BISI and the formation of the SIBI.

It’s worthy to note that the price may fall due to liquidity withdrawal. Hence, it may be wise decision to await the price to close above the SIBI zone before market entry for purchase.

You might also be interested in

Don’t miss any crypto news

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

Please enter your email address

Email is invalid

Read how we process your data in our Privacy policy.

Thank you for subscribing 😊

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

If you have any questions about cryptocurrencies or need some advice, I'm here to help. Let us know at [email protected]