Ethereum Spikes on ETF Approval Rumors

Ether's value jumped by more than 18% following comments from Eric Balchunas, a senior Bloomberg analyst, who increased the likelihood of an Ethereum exchange-traded fund (ETF) being approved from 25% to 75%.

What's in store for the 'mother of all cryptocurrencies' should the United States financial watchdog greenlight an ETF this week?

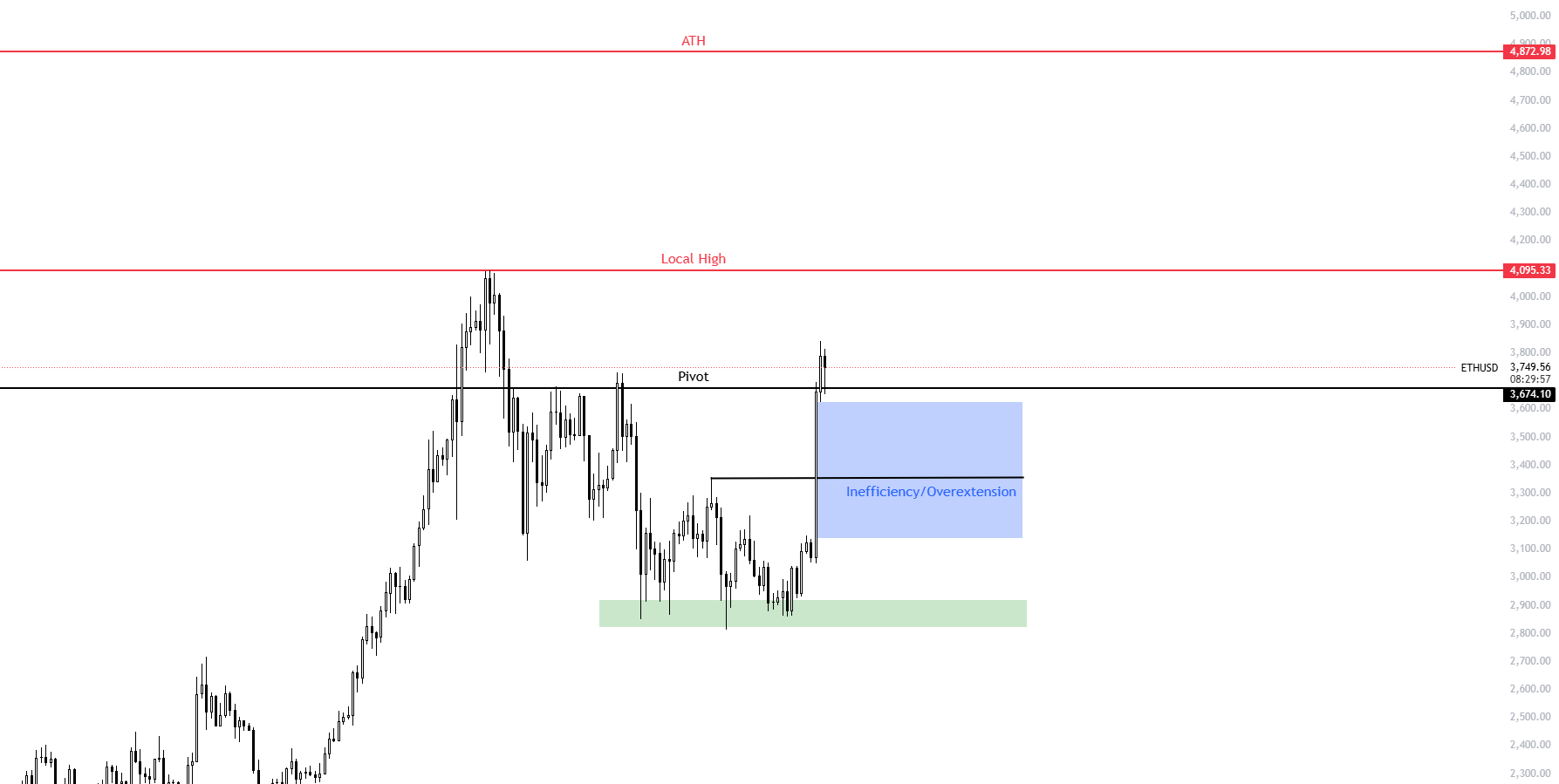

Daily time frame analysis

ETHUSD - 1 Day Time Frame

Currently, Ethereum is maintaining its strength above a significant price pivot from the previous bull market, which has now been tested twice for demand and held firm. With the potential approval of an ETF on Thursday, May 23rd, this rise in price is likely to prolong.

ETFs are a major catalyst that could propel Ethereum to new all-time highs and beyond. This pattern may mirror that of Bitcoin’s during its ETF approval, suggesting the market should brace for a potential pullback.

However, the prevailing strong sentiment might prevent a complete retraction of recent gains. It is likely that those who positioned themselves before the breakout or at the support range will not sell but may buy more in the event of a pullback once the ETFs are active.

15-minute time frame insights

ETHUSD - 15 Minute Time Frame

For traders and investors looking to enter the market now or to add to their positions, it would be prudent to wait for the ETF approval and observe the market's reaction.

From a trading standpoint, the optimal entry point may currently situate at the pivot, which has shown resilience with a false breakout, indicating underlying strength.

Lower timeframe highs should not pose significant resistance if sentiment and demand for the ETFs remain robust, suggesting that local highs could be revisited soon.

However, if the pivot/support is breached under strong selling pressure, it would be crucial to wait for a bottom to form before re-entering, as there could be a gap that needs to be filled.

Market expectations

The demand for cryptocurrency continues to grow, and expectations for Ethereum ETFs are high among major players. Standard Chartered Bank anticipates that the SEC (Securities and Exchange Commission) could approve spot ETH ETFs this week due to recent demands placed on NASDAQ and Cboe to update their ETF filings.

Additionally, asset manager Bernstein, with $725 billion under management, predicts that ETH could reach $6,600 following the approval of spot Ethereum ETFs. Furthermore, BlackRock has filed an updated 19b-4 form for its ETH ETFs, underscoring significant institutional interest.

Ethereum's prospects could brighten even more than projected, especially as cryptocurrency adoption is still far from saturation. The potential for growth remains substantial, making this an exciting time for Ethereum and its stakeholders.

You might also be interested in

Don’t miss any crypto news

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

Please enter your email address

Email is invalid

By sharing your email, you consent to recieving BITmarket's newsletter.

Read how we process your data in our Privacy policy.

You’ve made us very happy 😊

Subscribe to our Newsletters - the best way to stay informed about the crypto world. No spam. You can unsubscribe anytime.

If you have any questions about cryptocurrencies or need some advice, I'm here to help. Let us know at [email protected]