All Eyes on ETHFI

Launched just one month ago, ether.fi (ETHFI) has stolen the spotlight of the crypto scene. Focused on liquid re-staking solutions, ETHFI amassed an impressive market capitalization above $375 million, and is currently amongst the top 60 cryptocurrencies in trading volume.

Nearly tripling in value since mid-April, the cryptocurrency's price has repeatedly tested the crucial support zone, but recently it broke downwards.

This leads to the pivotal question: is it time to sell, or is there a potential for a trend reversal to the upside?

Daily time frame

From a retail market perspective, support levels are typically viewed as a safe place to execute orders. However, recent price movements suggest the contrary.

ETHFIUSDT - 1 Day Time Frame

In markets, the exchange of an underlying asset among participants often leads to price declines below support levels due to liquidity needs. When there is buying interest from Non-Commercial traders, it is crucial to have a counterparty ready to provide the necessary volume of sell orders.

The greatest accumulation of STOP orders usually occurs below fundamental lows and highs. For ETHFI, this situation involved multiple lows beneath which lay overlapping Sell Stop orders from early buy positions.

4 hour time frame

ETHFIUSDT - 4 Hour Time Frame

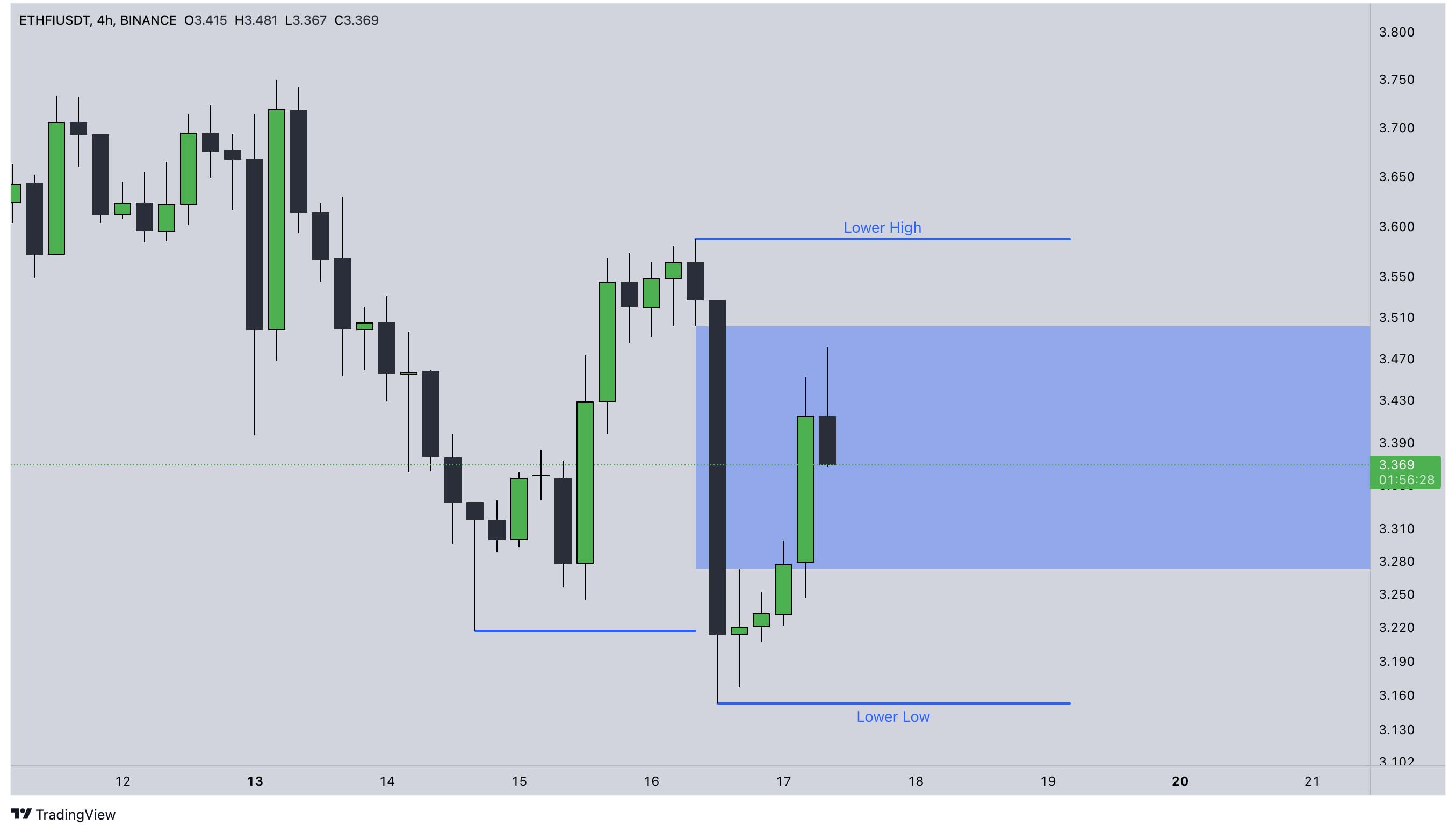

After establishing the initial necessity for buying positions—the selection of liquidity—it is essential to switch to a lower timeframe to analyze the situation more intricately.

Here, the key bearish structures are represented by Lower Highs and Lows. There is also a Fair Value Gap, which could potentially serve as strong support for the price and thus facilitate a bullish move, but only if a close above it occurs.

If the price continues to adhere to these bearish structures, it would be imprudent to enter into buying positions.

Key purchase points

If the price manages to close above the Lower High (LH) on the 4-hoour timeframe, it could signal an opportunity to initiate buy positions.

The targets for these trades would be the resistances identified on the daily timeframe, with a Stop Loss order strategically placed just below the Lower Low.

This setup aims to capitalize on a potential reversal while managing risk effectively.